It might sound a bit like a sponsored post, but I am just a big fan of this card. I use it when I travel, I like all the addons they developed to make my life easier.

Basic use of free Revolut

Use your bank card to load money on your

What’s great with Revolut – the security

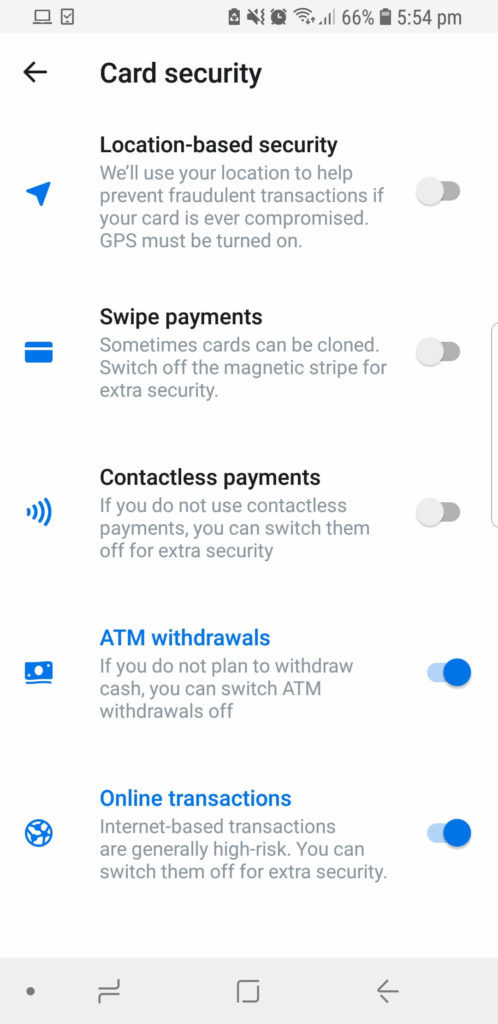

You have lots of card security options such as:

Location-based security- Swipe payments

- Contactless payments

- ATM withdrawals

- Online transaction

You can freeze your card, you can generate virtual cards for single use or multiple online transactions.

Set a limit on monthly spending. View and unblock your pin if needed.

That’s all basic feature of the free version.

Review of Revolut premium

You can have a premium or metal card with more advantages such as travel insurance (40 days per year max trip). A free lounge pass for the metal, a cashback system of 0.01% on all your card transactions outside of Europe (0.001 inside Europe). With Premium and Metal, you can also take out more at cash points, 400 and 600 pounds equivalent per month.

Bonus: Play with the currency

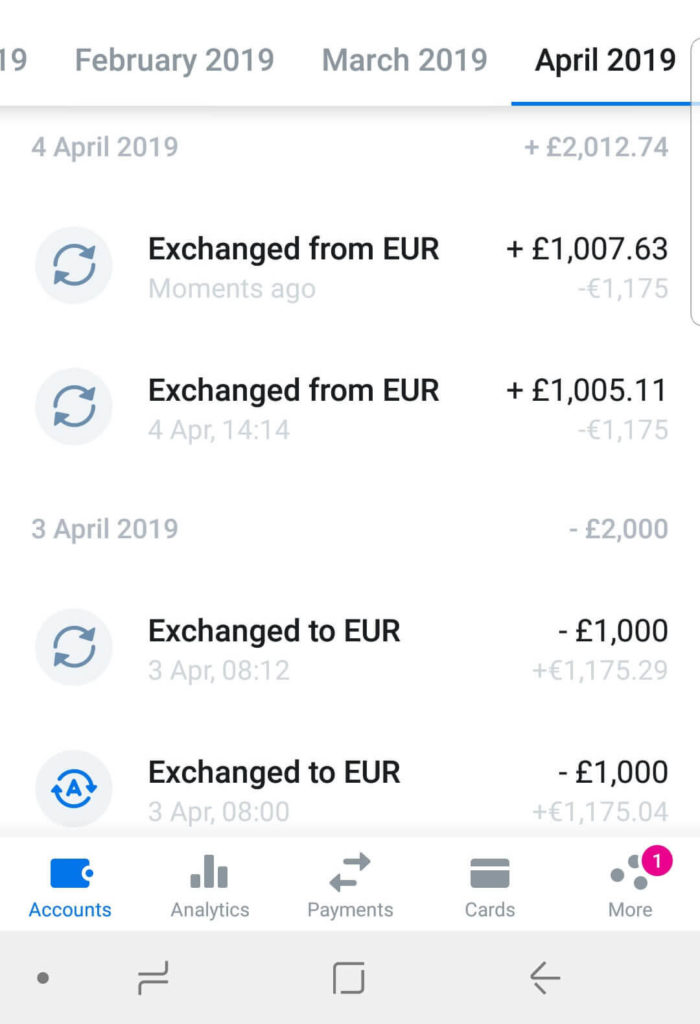

You know the concept of trading. Moving money from one account to another. Well, I do this with the pound sterling and euros and pound sterling and dollars. When the rate goes down, I move money from one account to another either manually or you can set it in the app to do an automatic transfer.

For instance, you can set, move £1000 into euros when the rate is superior at £1 = 1.175€ for instance. Then when the euro gets stronger move the money back and get £1005.11 that’s a fiver earned 😉

This is just an example.

Here is a screengrab, I moved twice 1k and moved them back the next day, with the rate moving I made £12.74

If you want an invite to get a free Revolut card, you can use this link.